Gain Unparalleled Insight into Your Investigation Performance

95%

Decrease in Outstanding

Referrals

50,000+

Settled Investigations

100m+

Fraudulent Claims Managed

10+

Ready Integrations

Centralise Your Investigation Data for a Single Source of Truth

A successful fraud investigation depends on reliable, consistent, and unified data. FraudOps centralises all investigation inputs—claims data, case notes, external intelligence, and fraud detection signals—into one secure platform, creating a true single source of truth. By eliminating data silos and reducing manual data entry, investigators gain immediate access to accurate, real-time information. This ensures every case is handled with full visibility, consistent evidence, and complete context. With streamlined collaboration and improved data quality, teams can close cases faster, enhance decision-making, and strengthen overall fraud operations.

Consolidate Data from All Internal Systems

FraudOps integrates seamlessly with internal systems such as claims management tools, policy databases, and fraud detection engines. This consolidation ensures investigators no longer need to navigate multiple systems or manually merge information. All relevant case records appear in one unified view, providing clarity and reducing investigative delays. With consistent and complete data available instantly, teams can assess risks accurately and prioritise cases effectively. This unified approach strengthens fraud investigation workflows and enhances operational efficiency.

Connect to External Data Providers Effortlessly

FraudOps supports integrations with external data partners including credit bureaus, public records, ID verification services, and industry databases. These connections enrich case information with verified, authoritative insights. Investigators can validate identities, assess risk signals, and detect inconsistencies without switching platforms. The ability to access broad, external intelligence strengthens fraud analytics and enables faster decision-making. This expanded visibility ultimately improves case accuracy and reduces the likelihood of missed red flags.

Maintain Data Accuracy and Reduce Manual Effort

By centralising data flows, FraudOps minimises manual entry and prevents duplicated or outdated information. Automated updates ensure investigators always work with the most current case details. This improves data integrity and reduces time spent cross-checking sources. With cleaner, more reliable data, teams can focus on high-value investigation tasks rather than administrative work. The result is smoother case management and clearer fraud insights.

Improve Cross-Team Collaboration on Complex Cases

A single data environment enables investigators, analysts, and managers to collaborate effortlessly. FraudOps provides shared access to case notes, evidence, and timelines, ensuring every stakeholder operates with the same information. This transparency prevents siloed decision-making and supports more coordinated action. Complex or high-risk cases benefit from faster handoffs, clearer communication, and a unified investigative strategy. The platform ultimately strengthens teamwork and improves investigation outcomes.

Track Key Performance Indicators (KPIs) to Drive Continuous Improvement

Tracking performance metrics is essential for improving fraud investigation processes and demonstrating measurable impact. FraudOps provides comprehensive KPI monitoring across investigation speed, case accuracy, resource usage, and financial recovery. With real-time dashboards and configurable reporting, insurers can assess team productivity, detect workflow bottlenecks, and refine detection models. These insights support data-driven decision-making and help organisations continuously enhance fraud operations. By aligning KPIs with strategic goals, teams gain visibility into what’s working, where gaps exist, and how to optimise performance across the investigation lifecycle.

Monitor Investigation Efficiency and Cycle Times

FraudOps tracks the full case lifecycle—from assignment to closure—giving teams visibility into average handling times and workload distribution. By identifying delays or backlogs, managers can optimise staffing, streamline queues, and improve throughput. Clear efficiency metrics help teams prioritise cases more effectively and maintain consistent investigation quality. This data-driven view ensures resources are allocated where they have the greatest impact.

Measure Fraud Detection Accuracy and False Positives

Accurate detection is essential for effective fraud operations. FraudOps records detection outcomes, false positive rates, and confirmed fraud cases, helping teams refine rules and analytics. By analysing these metrics, investigators can adjust triage thresholds and improve signal quality. This reduces wasted effort on non-fraud cases and increases focus on genuine threats. Better accuracy boosts investigator productivity and supports more reliable fraud analytics.

Track Financial Impact and Recovery Success

FraudOps monitors financial metrics such as recovery rates, estimated fraud savings, and cost per investigation. These KPIs provide a clear view of operational effectiveness and return on investment. Managers can assess which case types produce the highest recovery value and fine-tune strategies accordingly. Transparent financial reporting strengthens accountability and supports more strategic planning across fraud operations.

Evaluate Investigator Productivity and Performance

Productivity metrics—such as cases closed, time spent per case, and workflow completion rates—help organisations evaluate team performance. FraudOps provides fairness-focused insights that highlight strengths and support skill development where needed. These views allow managers to balance workloads, streamline processes, and build a high-performing investigation team. The outcome is a more motivated, efficient, and impact-driven workforce.

Leverage Business Intelligence to Uncover Hidden Fraud Patterns

FraudOps provides advanced business intelligence tools that help insurers uncover sophisticated fraud networks, emerging patterns, and hidden risks. By combining machine learning, behavioural analytics, and visual exploration, investigators can move beyond reactive case handling to proactive prevention. BI capabilities reveal trends, unusual activity clusters, and connections between entities. This empowers organisations to anticipate risks, strengthen fraud strategies, and respond faster to evolving threats. With deeper insights and visual clarity, FraudOps enables more informed decision-making and stronger fraud investigation outcomes.

Detect Emerging Trends with Advanced Analytics

FraudOps enables investigators to analyse historical and real-time data to identify shifts in fraud behaviour. Trend analysis helps teams spot rising schemes, seasonal patterns, or new attack vectors early. By understanding how fraud evolves, organisations can adjust controls, refine rules, and stay ahead of criminal tactics. Trend insights support more proactive fraud prevention and strategic resource allocation.

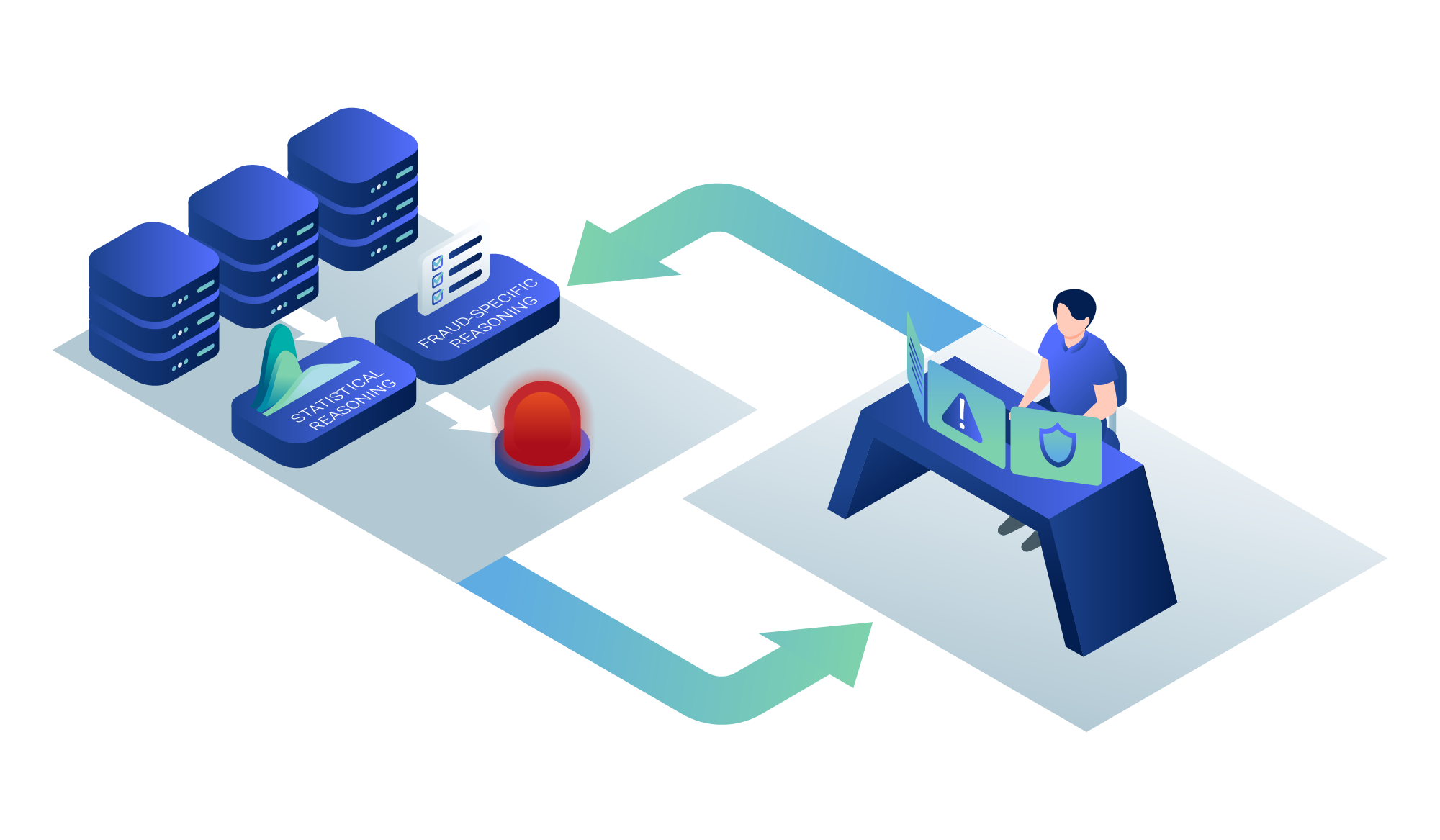

Identify Suspicious Patterns Using Machine Learning

Machine learning models within FraudOps highlight anomalies and detect unusual activities that may indicate fraud. These patterns could involve repeated behaviours, inconsistent information, or hidden relationships. ML-driven insights reveal risks that manual reviews might overlook. Investigators benefit from clearer signals, prioritised alerts, and enhanced accuracy in identifying potential fraud cases.

Visualise Links Between Entities with Link Analysis

Link analysis tools allow investigators to map connections between individuals, addresses, phone numbers, and claim details. These visual networks expose organised fraud, repeated offenders, and related entities. By seeing how different data points connect, teams can better understand complex schemes. Link analysis strengthens fraud investigation depth and supports more effective case resolution.

Use Geospatial Insights to Identify Hotspots

FraudOps includes geospatial analysis capabilities that map fraud activity across regions. Investigators can spot high-risk locations or clusters of suspicious claims. These insights support targeted interventions, resource planning, and risk scoring models. Geographic patterns provide valuable intelligence for both proactive prevention and strategic decision-making.

Customise Dashboards and Reports to Meet Your Specific Needs

FraudOps offers flexible dashboards and reporting tools that adapt to the needs of investigators, managers, and executives. Users can create tailored views to monitor fraud KPIs, case progress, team performance, and financial outcomes. With intuitive drag-and-drop interfaces, custom filters, and real-time updates, each stakeholder gets the insights they need to act quickly and confidently. Whether tracking portfolio trends or reviewing a single investigation, the platform ensures data is presented clearly, consistently, and in a way that supports fast decision-making and operational excellence.

Build Tailored Dashboards for Every Role

FraudOps allows each user group—investigators, team leads, analysts, executives—to create dashboards suited to their responsibilities. Investigators can track case queues and task progress, while managers focus on productivity and KPIs. Custom dashboards ensure every stakeholder sees relevant insights instantly. This role-based approach enhances clarity and supports better operational decisions.

Use Real-Time Reporting to Support Fast Decisions

Real-time reporting in FraudOps keeps teams updated on case status, risk levels, and performance metrics. Live data eliminates outdated information and helps investigators respond quickly to urgent cases. Managers benefit from up-to-date trends that support proactive planning. Real-time insights strengthen fraud operations and enable faster, more confident actions.

Configure Visualisations That Highlight Key Insights

FraudOps supports charts, tables, metrics, and visual elements that highlight patterns and priorities. Users can choose the formats that best present their data, ensuring clearer interpretation. Consistent visual design improves usability and supports quick analysis. Custom visualisations help teams understand performance and risks at a glance.

Export and Share Reports Across the Organisation

Reports can be exported and shared with investigators, executives, auditors, and other departments. This ensures alignment across teams and supports transparent communication. Whether reviewing monthly KPIs or discussing case trends, shared reports keep everyone informed and coordinated. This strengthens governance and builds confidence in investigation outcomes.

Ensure Regulatory Compliance with Comprehensive Audit Trails

Operating in a regulated environment requires complete transparency, secure data handling, and adherence to industry standards. FraudOps supports compliance by maintaining detailed audit trails, enforcing role-based access controls, and safeguarding personally identifiable information. Every action taken within a case is recorded, ensuring clear accountability and traceability for internal reviews or external audits. With robust data governance, insurers can demonstrate compliance with FCA guidelines, GDPR requirements, and best-practice fraud investigation standards, reducing risk and strengthening trust across their fraud operations.

Maintain Detailed Action Logs for Every Case

FraudOps automatically records every action taken within a case, creating a complete audit trail. This includes edits, assignments, evidence uploads, and status changes. These logs provide transparency and credibility during audits or legal reviews. Clear traceability ensures cases are handled ethically and in compliance with regulatory standards.

Enforce Role-Based Access Controls

The platform ensures that only authorised users can access sensitive information. Role-based permissions protect personal data and ensure investigators view only what is relevant to their responsibilities. This reduces the risk of data misuse and supports compliance with GDPR and other regulatory frameworks.

Protect Sensitive Data with Secure Protocols

FraudOps uses secure storage, encryption, and controlled access to protect sensitive case information. These safeguards help insurers maintain strong data governance and prevent unauthorised exposure. By ensuring data security at every stage, the platform supports regulatory compliance and strengthens organisational trust.

Support Compliance Reviews with Clear Reporting

Compliance teams can generate detailed reports summarising case activity, investigator actions, and system usage. These insights help organisations demonstrate adherence to regulatory expectations and internal policies. Clear compliance reporting simplifies audits and reinforces strong governance practices.

Integrate with Your Existing Systems for a Seamless Workflow

FraudOps is built to fit naturally into your existing technology ecosystem. The platform integrates with claims systems, fraud detection tools, third-party data sources, and internal applications through APIs and secure connectors. This interoperability reduces manual effort, eliminates duplicate tasks, and provides a holistic view of each investigation. By bringing together data and workflows from multiple systems, FraudOps enhances operational efficiency and ensures investigators have everything they need in one place. The result is a streamlined, connected, and scalable fraud operations environment.

Connect Seamlessly to Claims and Policy Systems

FraudOps synchronises with claims management and policy platforms to provide instant access to case data. Investigators can view claim history, customer information, and related documents without switching applications. This integration accelerates investigation workflows and reduces administrative overhead.

Integrate with Fraud Detection Engines and Alerts

The platform can ingest signals from fraud detection engines, machine learning models, and external alert systems. This ensures investigators receive consistent, reliable fraud indicators in one unified interface. Integrated alerts help teams prioritise high-risk cases and act quickly on credible signals.

Incorporate External Data Sources for Enriched Insight

FraudOps connects with third-party data providers such as identity verification services, sanctions databases, and public records. These integrations enrich investigations with additional context and authoritative information. The expanded visibility strengthens fraud analytics and supports more confident decision-making.

Streamline Workflows by Reducing Manual Tasks

Automated data flows reduce the need for manual data entry and eliminate repetitive administrative tasks. Investigators spend less time managing systems and more time analysing cases. This efficiency improves productivity, reduces errors, and delivers faster investigation outcomes.

Effective Investigation Management

Get a comprehensive guide packed with best practices, workflow optimisation strategies, and insights on using automation to improve fraud investigation performance.